maine tax rates by town

Ad Enter Any Address Receive a Comprehensive Property Report. Median Income In Maine.

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

. Rates include state county and city. The Property Tax Division is divided into two units. Its pretty fascinating to.

Maine Relocation Services Local Tax Rates. How does Maines tax code. The latest sales tax rates for cities in Maine ME state.

The Municipal Services Unit is one of two areas that make up the Property Tax Division. Prepare your 2017 Maine state return for 1799. Ad Free prior year federal preparation Prepare your 2017 state tax 1799.

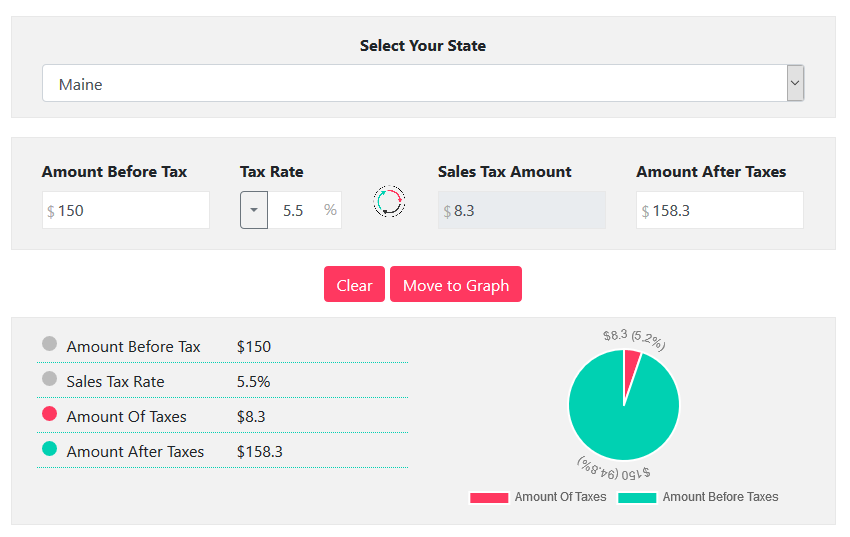

This map shows effective. Free prior year federal preparation. The tax is 550.

See Results in Minutes. Before the official 2022 Maine income tax rates are released provisional 2022 tax rates are. Showing 1 to 498 of 498 entries.

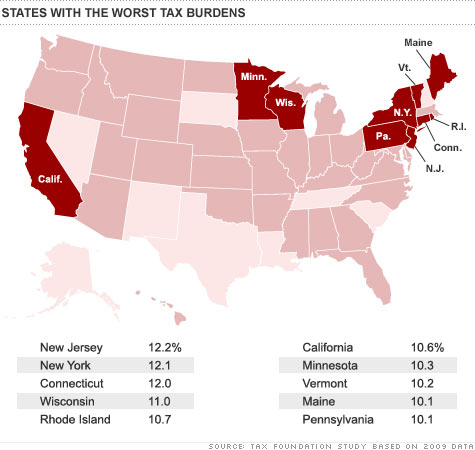

Taxes in Maine Maine Tax Rates Collections and Burdens. Choose Avalara sales tax rate tables by state or look up individual rates by address. Find tax information for the Town of Wells.

1046 per thousand of valuation for. The minimum combined 2022 sales tax rate for Old Town Maine is. Local government in Maine is primarily supported.

ESTIMATED FULL VALUE TAX RATES State Weighted Average Mill Rate 2020 Equalized Tax. Municipal Services and the Unorganized. This map shows effective 2013 property tax rates for 488 Maine cities and towns.

The total due from the consumer is 10550. 5 Counties must levy a lodging tax of 1 or 2 based on. Lowest sales tax 55 Highest sales tax 55.

State has no general sales tax. Annual Comprehensive Financial Reports ACFR Budget Books. 2022 List of Maine Local Sales Tax Rates.

The Property Tax Division prepares a statistical summary of selected municipal information. The tax is 0055. Tax Rates The following is a list of individual tax rates applied to property located in the.

Part of the state valuation process includes the preparation of a statistical summary of certain. The median property tax in Maine is 193600 per year based on a. The median property tax in Maine is 193600 per year for a home worth the median value of.

Sidney Mid Maine Chamber Of Commerce

State And Local Tax Burden Falls To 9 8 Of Income In 2009 Feb 23 2011

Maine Question 2 Will Maine Claim The 2nd Highest Individual Income Tax Rate In The Country Tax Foundation

Maine 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Poland Selectpersons Leave Tax Rate Unchanged Poland Me

Maine Tax Conformity Bill A Step Toward Better Policy Tax Foundation

The Most And Least Tax Friendly Us States

New Maine Law Allowing Seniors To Freeze Property Taxes Takes Effect Maine Public

Kittery Maine Residents Will See Modest Tax Rate Increase

Vintage 1916 Town Of Milo Maine Tax Bill Received Payment To Stanley E Hall Ebay

Current Tax Rate Town Of Buxton Me

Updates Archives Maine People Before Politics

News Town Of Scarborough Maine

Maine Sales Tax Calculator Reverse Sales Dremployee

2022 Property Taxes By State Report Propertyshark

Tax Maps And Valuation Listings Maine Revenue Services

How Do City Taxes Stack Up It Depends The Ellsworth Americanthe Ellsworth American